Financial Literacy class with Mr. Carlson

Why should students be knowledgeable in finance?

Finances can be managed in a variety of ways to stay organized.

October 18, 2022

LOS ALAMITOS, CA — Our country is built upon economics and dealing with finances whether people are interested in business or afraid of it. Part of the fear with finances is a lack of understanding. Very few students are aware of the Financial Literacy class held here at Los Alamitos High School led by Mr. Carlson, who also teaches economics and coaches the Girls’ Water Polo team. Open to juniors and seniors, Financial Literacy teaches the fundamental topics that students will experience once they have financial obligations.

The class provides counseling on how to manage, save, and invest money. The course also advises on how to start early with boosting students’ credit scores. Students learn how to work within a budget as well as learn financial terminology such as “buckets,” a method for categorizing assets, as a tool to save money.

Assessing peoples’ shopaholic behaviors will benefit their daily living expenses. Other common occasions like booking flights and hotels as well as renting and buying cars are also discussed in Financial Literacy to equip students with travel knowledge.

Even if an individual hires a tax professional to do their taxes, it is essential for them to understand how finances work themselves and how they can benefit from assets and manage liabilities. Students will build strong money habits as well as have the ability to work around not having to rely per paycheck.

“[In] June 2022, 61% of Americans were living paycheck to paycheck,” according to Cision, a public relations and media software company. This current struggle could worsen in the future if students are not utilizing classes like Financial Literacy.

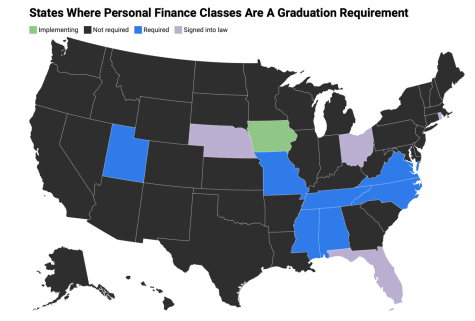

Forbes Advisor said that, as of now, 10 states have implemented laws requiring high school students to take at least one personal finance course. People may argue that personal finance has already been implemented into other classes like economics. While this may be partially true, students do not learn most of the essential skills they can employ outside of the classroom.

Mr. Carlson suggested that seniors transitioning into college take on as little debt as possible due to the financial struggle many face because of their lack of knowledge about the process.

“There are people I know who have student loan payments larger than my mortgage and they can’t afford to buy a house because they have accumulated debt in student loans and credit cards,” Mr. Carlson said.

The stigma that one only needs to worry about finances if they are majoring in business or finance needs to be dismantled. Financial Literacy is a course that needs more recognition due to finance’s demanding presence in students’ lives.