LOS ALAMITOS, CA – Every year, approximately 17 million students in the U.S. apply for the Free Application for Federal Student Aid (FAFSA). For 32 years, FAFSA has been an easy, effective way for students to see if they are eligible for financial aid. Whether a student comes from a low-income or a high-income household, they are able to fill out the FAFSA form and have access to federal student loans if they need them.

When FAFSA decided to create a new, simpler version of their originally 108-question form, it seemed as though financial aid access would be easier. According to the U.S. Department of Education, “Better FAFSA” was intended to allow students and their families to complete the streamlined form in less than 15 minutes. It also promised that 665,000 more students would receive federal Pell Grants to pay for college. Unfortunately, delay after delay caused more frustration than appreciation toward the new form.

“The point was to offer more money to students in need and to make it simpler. [Now,] it’s more confusing, there are so many steps and, there have been so many errors that fewer kids are applying for funds,” Los Alamitos High School’s College and Career Counselor, Mrs. Schaeffer, said. “That’s the exact opposite of what they hoped it would do.”

How the delays affected the college admissions process

Because of the new updates to the FAFSA form, it was not available on the typical Oct. 1 release date. According to CNN, the updated form was required by law to be available on Jan. 1, but the form still wasn’t fully accessible for 24 hours a day, seven days a week until Jan. 8. This was mainly due to a message that appeared on the top of the website about a “Soft Launch Form Maintenance.”

This message meant that the FAFSA form was only available for short periods of time for a few weeks. Additionally, students reported that complications caused the form to be taken down multiple times before it was permanently available on the website. Students could only access FAFSA during early morning or early afternoon to work on the form, and it was typically best to work on it during the week rather than a weekend because the form would not glitch as much.

The glitches were among many inconveniences that families faced while attempting to work on the form. Other obstacles included application processing delays, a social security number error, unauthorized student completions of parent sections, and some forms had to be resubmitted due to a “Provide Signature” button defect.

Some students found the process to be very stressful. Nathan Yee, a Los Al senior, was one example. He applied to over 30 colleges and had to call FAFSA to manually add more colleges to his FAFSA report because he surpassed the allotted number of colleges he could add. This caused him to wait for an extensive amount of time in a virtual waiting room.

“I really don’t like the fact that they have a limit on that and they make you call them to schedule it,” Yee said. “Also, having your parents go in and do their own thing in the portal was kind of annoying because my parents are not tech-savvy at all.”

Additionally, the “Provide Signature” error was particularly frustrating for some families, as they were ineligible for any financial aid without the signature. FAFSA had said that the error would be resolved in early March. However, most FAFSA applicants who dealt with the unclickable button did not have the ability to submit their forms until early or mid April.

Thankfully, other students did not have this issue. Los Al senior Aaron Litt spent time thinking about where he wanted to attend college and was able to get his FAFSA offer quickly.

“I decided when the FAFSA information came out, so I had everything I needed to make a decision,” Litt said.

A U.S. Department of Education press release explained that 4.7. million families managed to submit their FAFSA application for the 2024-2025 academic year by Feb. 27. However, this number is a 38% drop compared to previous years because there were 7.6 million families that filled out their FAFSA for the 2023-2024 academic year.

The college effect

It has been evaluated over the years that families who successfully complete the FAFSA form are 84% more likely to enroll in college directly after graduation, Forbes explained, while families that do not fill out the form are less likely to attend college. At the same time, however, the FAFSA delays also have affected college enrollment processes.

“Normally, what would have happened is you get an acceptance and either in that same email there’s a link to your financial aid award letter, or within a week you’re notified,” Mrs. Schaeffer said. “With FAFSA not even submitting to the schools until the middle of April, the [colleges are] trying to figure out how to give as much aid as possible to as many students as possible.”

Overall, “Better FAFSA” has impeded the normal timeline for the college planning processes. Mrs. Schaeffer explained that colleges normally have months to distribute financial aid packages, figure out enrollment deadlines, and even start planning for housing and other amenities. However, the delays caused some colleges to push back commitment deadlines to dates such as May 15 or June 1, and they have had approximately two months to figure out how to distribute financial aid to applicants.

Some seniors also have waited longer to commit to a school because of this. It has slowly created a domino effect on the entire college process, leading to the big question: What can future graduating classes expect?

Now what?

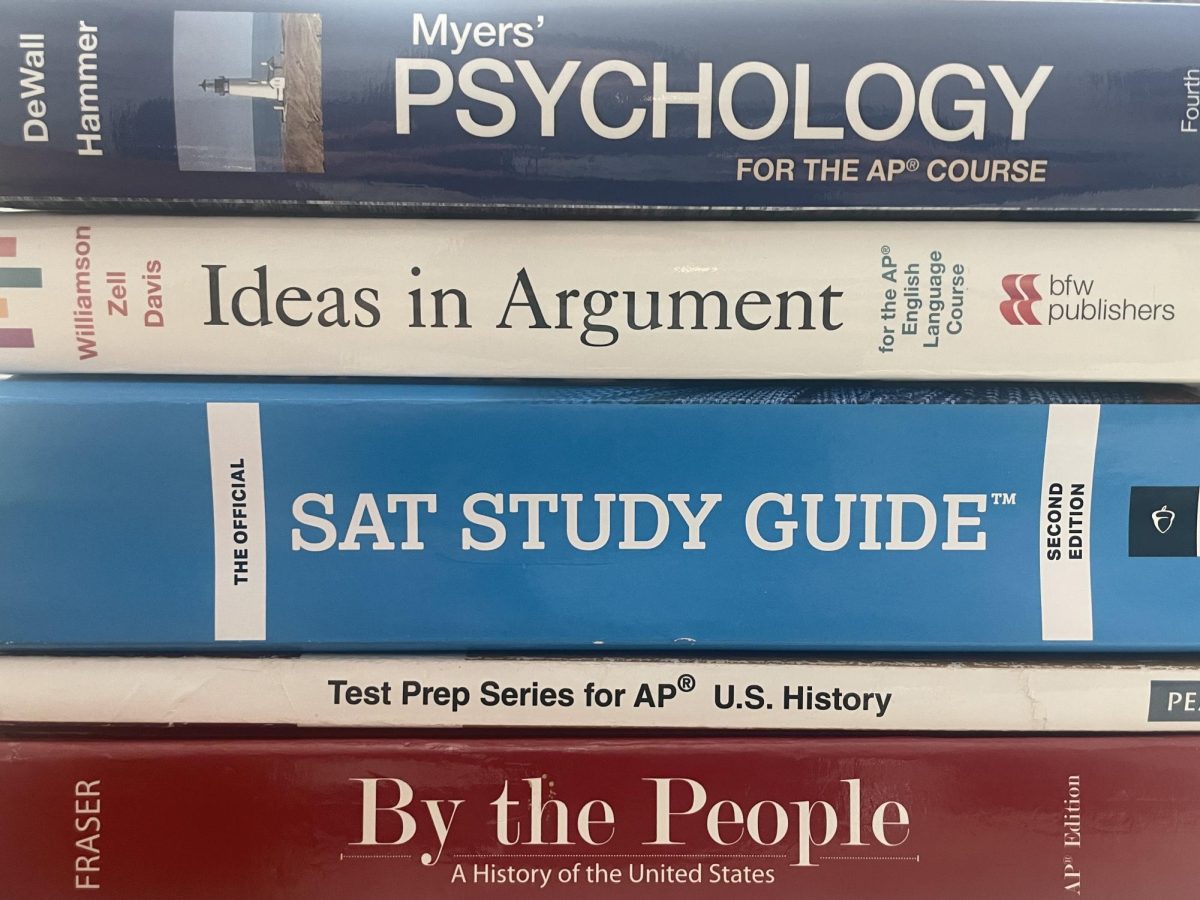

As of right now, Mrs. Schaeffer explained that current juniors will likely be able to apply as test optional to colleges as the class of 2029, but more colleges are also saying that they will require the test. Current freshmen and sophomores will most likely have to submit SAT or ACT scores, but there is still no confirmation about this. Yee believes that the test scores will balance out the applicant pool.

“I feel like less people are going to be applying if they aren’t scoring as well or if they didn’t take the SAT at all, so I feel like for a lot of universities the acceptance rates are going to go back up,” he said.

On the other hand, Litt feels that the competitiveness of current students will continue to change acceptance rates. In his opinion, most students try to do so much in high school that diminishes the qualities of other great applicants.

“I think every year it is getting more difficult to get into colleges because it seems [that] kids are trying to beat the system,” he said.

It’s difficult to tell what the future of college admissions looks like, but FAFSA has definitely played a role in changing the outcome of the college cycle for future generations.